We all know that these days Blockchain Technology is a trending topic for good and bad. Normally I would get straight to the point but we can not leave FTX without a mention and the wave of pain it has brought to the crypto market since last week.

All this attention brings many questions on how Crypto Exchanges should be regulated. We know that Banks and Governments can not stay out of it and are looking forward to taking control back. We are almost in 2023 but this comes a long way back... and that is why I want to bring to you the concept of CBDC.

A CBDC comes from Central Bank Digital Currencies. Yeah, a currency issued for Central Banks but in this case is not physical, is digital! It is a new type of money that uses Blockchain Technology.

Governments have been playing with it for a while with CBDC to adapt to this new era of Blockchain Technology. Also, creating Central Bank Digital Currencies has many reasons behind it because it solves a few problems in the financial system that we have these days. We all know that to send money between banks the transfer can take like 2-5 days.

Another big problem that banks have is that for example, if you want to send money from a Dominican Republic Bank to a Spanish Bank they can charge you 13-18% in commissions... that's just simply brutal! Imagine sending 20K, if they charge you 10% it is 2000 $. No way I'm paying that.

Now that we have more information on some of the main problems of Banks let's talk about how CBDCs would help us. One of the main reasons to create CBDC is because it optimizes national and international interbank transactions like payments, and loans... by reducing the operational costs of these operations (depending on which blockchain you are using the commissions are way cheaper). Another big reason is the increase in the speed of transactions (no more than 2-5 days of waiting, and in minutes you got your money) and security by using Blockchain or DLT (Decentralized Ledger Technology).

So far, you know some of the problems and solutions but, are Banks and Governments implementing this technology or is it just some perfect idea which never will be used? I have to tell you, I was SURPRISED when I read the latest document from Deloitte: The Future of Money and Banking 2022 and I wanted to show you some of these projects for you to stop thinking this is some bull****:

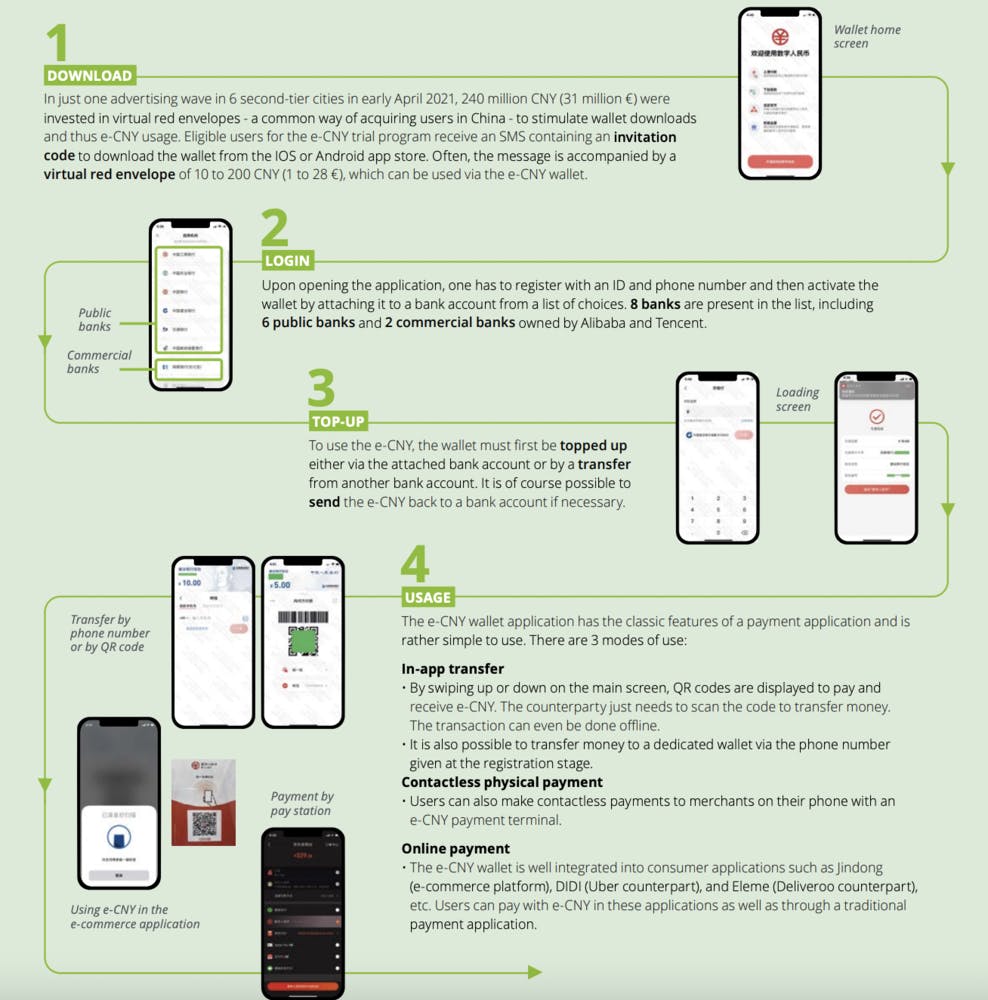

- China has launched its own CBDC Pilot which is being used by people. The 2022 Winter Olympic Games organized in February in China have marked history for the e-CNY (Chinese Yuan or Digital Renminbi) as a big opportunity to test the currency and a potential international expansion: only e-CNY, Visa and cash were proposed as payments systems to domestic and foreign participants; and the digital renminbi has been increasingly used with a mean of 315 000 $ of transactions per day.

2. More than 80 Central Banks have launched their CBDC research or/and experimentation projects around the world. Traditional banking actors and tech firms are starting to take a serious interest in these assets and want to embrace this movement to avoid being left behind.

3. The Bahamas, in October 2020 launched its own currency: the sand dollar, hoping to bring greater financial inclusion to underserved communities in the archipelago, whose complex geography of 700 islands and remote keys throws up challenges in securely distributing cash. The sand dollar is issued by the Central Bank of The Bahamas to digital wallets held by an initial tranche of six licensed money transfer and payment firms. Through them, people and businesses can access, hold and spend virtual dollars via a mobile phone app.

4. Sweden is also looking to become the first major Western economy to officially launch a CBDC, the eKrona, backed by the country’s central bank, Riksbank.

5. The Banque de France has been working on CBDCs since 2017, with the world’s first interbank blockchain implemented by a central bank: the Madre project. Between 2020 and 2021, it launched 9 experiments (which are presented below) with a selected group of financial stakeholders to assess the risks and opportunities of using wholesale CBDCs for clearing and settlement procedures of tokenized financial assets. Following the success of these experiments, the Banque de France wanted to start to pursue CBDCs tests on cross-border operations this year.

With all the information offered before, I think that all of you can leave this article with a little more knowledge on CBDCs and how Blockchain Technology is affecting Governments, Banks and will keep disrupting the world.

On the other hand, I can not end this article without saying that all this is not a fairy tale and many points have to be taken into account to be able to trust the system again. We are talking about Governments and Banks tracking and almost controlling our money by putting an end date to the money and a lot more things if you let your mind take a long trip. But that, we are gonna leave for another episode on CBDCs.

I hope to have helped you understand the technology a bit more and that you liked it. See you next week ;)